Business Loan

Feel free to get in touch

about Business Loan

Overview

The foremost priority of any entrepreneur is to see his/her business grow, expand and flourish.

To fulfill this desire, business owners opt for business loans and meet their financial requirements.

Just like a personal loans, a business loan can also be used for multiple purposes as long as they are related to your business. Once you pass the business loan eligibility criteria, you are all set to receive your loan. Business loans come in various forms like bank loans, asset-based financing, invoice financing, microloans, SBA loans, and a lot more. After comparing these options, you can opt for the one that best matches your need. At Finway FSC, we enable your business to meet its funding requirements by assisting you in making an informed decision.

Categories

Finway FSC offers both secured and unsecured business loans based on state and need of the business. There are three types term loans available as follow:

- Short-term loans

- Long-term loans

- Intermediate loans

The repayment schedule of term loans can be monthly or quarterly. Based on the term loan secured, the type of interest can be floating or fixed.

A demand loan needs to be repaid based on the demand schedule. Banks and the financial institutions offer both secured and unsecured demand loans. The repayment tenure of demand loans extends up to maximum 12 months.

Such loans are offered based on bank approved financial securities such as insurance policies, mutual funds, demat shares, saving bonds, fixed maturity plans etc. Such loans can be secured to mitigate an immediate financial crisis.

Eligibility

The eligibility for securing business varies based on the profile of the applicants. Based on the type of business the applicant engages, the applicants fall into three broad categories.

Self-Employed Professionals

The professionals such as company secretaries, architects, doctors, chartered accountants etc. come under this category.

Self Employed Non-Professionals

The applicants such as manufactures and traders fall into this category.

Entities

a. Partnership firms, LLPs, private limited companies and closely held limited companies

b. As part of the eligibility criteria, the applicant needs to fulfill the below to apply for a business loan.

- Must have a business turnover of Rs. 40 Lakhs

- Must run the current business for at least three years

- Must have five years of total business experience

- The business must be in a profitable state for the last two years

- Must have an annual income of Rs. 1.5 Lakh per annum

- Applicants should be in the age group of 21 to 65

Finway Advantage

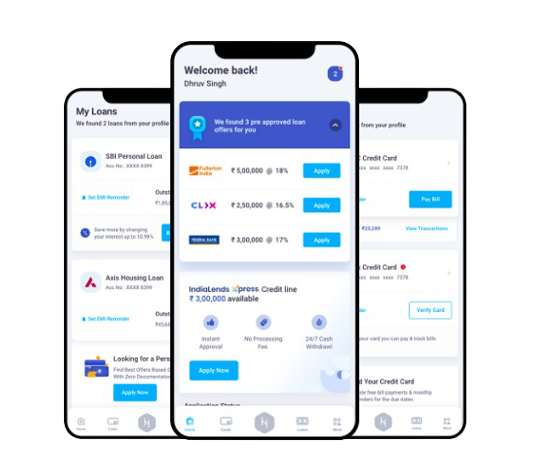

- Instant online approval. Loan sanction in 30 mins, disbursal in as low as 2 hours.

- Loan amount from Rs 5,000 - Rs 5 Crores

- Tenure: 3 months to 18 months

- Interest rate from 12% to 26% per annum

- Processing Fee: 3% to 5% OR Rs. 500, whichever is Higher

Trusted Banks

Best Business loan offers

from India’s most trusted banks

| Salaried | Self-Employed | ||

Age |

21 years to 60 years

|

22 years to 55 years

|

|

Net Monthly Income |

Rs.15,000

|

Rs.25,000

|

|

CIBIL Score |

Above 750

|

Above 750

|

|

Minimum Loan Amount |

Rs.50,000

|

Rs.50,000

|

|

Maximum Loan Amount |

Rs.25 lakh

|

Rs.30 lakh

|

|

Documents Needed

- Identity Proof (Aadhaar Card, Voter ID, Driving License, Passport, etc.)

- Address Proof (Valid ID proof with permanent address)

- Income Proof (Bank statement from the last 3 months)

Documents for NRIs

- Copy of your Passport

- Visa Copy

- Your official Email ID or the Email ID of the HR

- Bank Statements

- Salary Certificate or salary slips

- NRO/NRE bank statements of the last 6 Months

- Proof of Identity, Residence, Income, and Assets

- Recent passport-size Photographs of yourself and the guarantors

EMI Calculator

How much do you need loan for you?

98%

Satisfied Customers

Reviews

Minimal turnaround time, knowledgeable staff, excellent services, and everything digital; my experience from Finway has been very convenient. Everyone at Finway, not only listens but also understands customers and their needs. This is what a customer looks for when s/he seeks loans from lenders. For me, Finway is a go-to loan provider that keeps everything hassle-free.

The overall experience, starting from applying for a personal loan to its processing, and the final step when I received the loan, was smooth. Thanks, Finway for doing it with no hassles and in such a short interval. Great coordination among the internal teams, unmatched services, diligent follow-ups, all these aspects make Finway a great lending institution in India.

For any businessman, finance is paramount, especially in the initial phase of business. You may face a shortage of funds during the infancy of your business. My story is no different. However, when I applied for a business loan from Finway, I experienced a very smooth functioning and hassle-free disbursal process. The experts at Finway were so quick, understanding, and most importantly. Thanks!

Featured In

FAQs

What kindly security accepts by the banks while applying for a business loan?

Currently, to avail business loan banks we do not ask for any security. The business loans are offered based on the evaluations of the submitted documents along with the duly filled application.

I am event manager and have been working in the industry for almost 9 years. Am I eligible for a business loan to set up my event management company?

Yes, you will be eligible for availing a business loan based on the evaluation of the submitted document along with your business plan.

Do banks ask for personal details to use an EMI calculator of a business loan?

No, it is not mandatory to provide personal details to use an online EMI calculator

Where I can use the amount received via business loan?

You can apply for a business loan to fulfill the below requirements-

- Fund your new or existing business

- Make additional capital available for your business

- Renovation of home

- Expansion of business

- Expenses for your child's education

How long it takes to know the eligibility of business loan?

In the advent of the Internet, today, most of the banks and lenders offer efficient online services to its customers. With the help of online banking tools, applicants can check their eligibility to avail a business in a fraction of one minute

How much is the minimum and maximum loan amount I can get?

The minimum loan amount offered is Rs. 5,000 and maximum loan amount can exceed Rs. 2 crore, depending on the requirements.

What is the maximum age of availing business loan?

The maximum age of availing a business loan is up to 65 years.

What is the interest rate offered under Business Loan?

Interest rate offered by various banks and Financial Services Companies starts from 14.99% onwards.

For how long I can repay the loan amount?

You can repay the loan amount in minimum 12 months and maximum up to 5 years, depending on the respective bank or Financial Services Company.

Do I need to submit any collateral to bank before applying for a business loan?

No, you are not required to submit any collateral to bank or Financial Services Company.

What are the foreclosure charges and processing fees of business loan?

The foreclosure charges and processing fees varies from bank to bank. Every bank and Financial Services Company has different charges, so you need to check online from their official website.