Personal Loan

Feel free to get in touch

about Personal Loan

Overview

Nearly 3 million Indians from all over the country, and all walks of life, trust Finway Capital as their partner to fulfil a host of needs.

Nearly 3 million Indians from all over the country, and all walks of life, trust Finway Capital as their partner to fulfil a host of needs. In all of these partnerships, we have promised and delivered the best value for money, with transparency and simplicity.

We believe that when your needs are met, you are motivated to move ahead in life with passion and confidence. We strive to make your journey fruitful at every step with tailor-made solutions, and the simplest process.

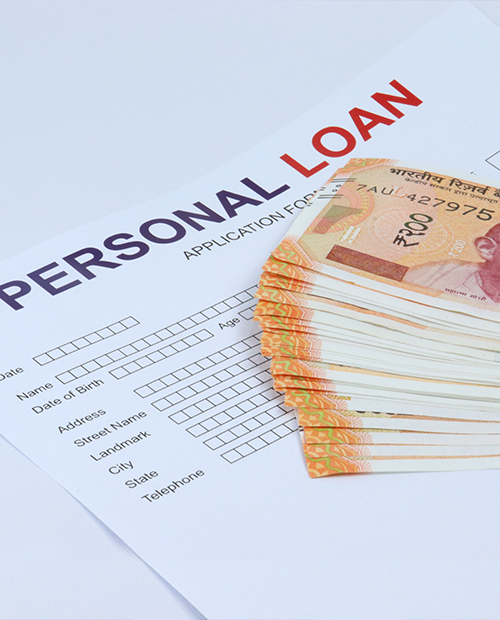

A personal loan is an unsecured loan, which can be used for many purposes. You can effectively turn your dream into reality by opting for our personal loan. Now you can take that vacation that has been delayed for long, or renovate your home, or even buy that dream car. It is commonly used to meet such financial needs as debt consolidation, wedding expenses, unexpected medical costs, home renovation and others. Flexibility of usage, minimal documentation and quick processing make personal loan a preferred financing option.

Finway Advantage

Finway FSC's personal loans with a personal touch!

Finding the perfect personal loan for you is the first, most important step. We at Finway FSC work tirelessly to exceed your expectations, and simplify all that you need to know. Whether you are looking at managing debt or dealing with an unexpected expense, we are right there when you need a timely solution. With simple and convenient processes, you can apply for an instant personal loan online. Personal Loans from Finway FSC come with several benefits and features, including minimal documentation, flexible repayment, quick disbursals, and maximum value for money.

- Instant online approval. Loan sanction in 30 mins, disbursal in as low as 2 hours.

- Loan amount from Rs 50,000 - Rs 30 Lakhs

- Tenure: 3 months to 18 months

- Interest rate from 12% to 26% per annum

- Processing Fee: 3% to 5% OR Rs. 500, whichever is Higher

Trusted Banks

Best personal loan offers

from India’s most trusted banks

| Salaried | Self-Employed | ||

Age |

21 years to 60 years

|

22 years to 55 years

|

|

Net Monthly Income |

Rs.15,000

|

Rs.25,000

|

|

CIBIL Score |

Above 750

|

Above 750

|

|

Minimum Loan Amount |

Rs.50,000

|

Rs.50,000

|

|

Maximum Loan Amount |

Rs.25 lakh

|

Rs.30 lakh

|

|

Documents Needed

- Identity Proof (Aadhaar Card, Voter ID, Driving License, Passport, etc.)

- Address Proof (Valid ID proof with permanent address)

- Income Proof (Bank statement from the last 3 months)

Documents for NRIs

- Copy of your Passport

- Visa Copy

- Your official Email ID or the Email ID of the HR

- Bank Statements

- Salary Certificate or salary slips

- NRO/NRE bank statements of the last 6 Months

- Proof of Identity, Residence, Income, and Assets

- Recent passport-size Photographs of yourself and the guarantors

EMI Calculator

How much do you need loan for you?

98%

Satisfied Customers

Reviews

Minimal turnaround time, knowledgeable staff, excellent services, and everything digital; my experience from Finway has been very convenient. Everyone at Finway, not only listens but also understands customers and their needs. This is what a customer looks for when s/he seeks loans from lenders. For me, Finway is a go-to loan provider that keeps everything hassle-free.

The overall experience, starting from applying for a personal loan to its processing, and the final step when I received the loan, was smooth. Thanks, Finway for doing it with no hassles and in such a short interval. Great coordination among the internal teams, unmatched services, diligent follow-ups, all these aspects make Finway a great lending institution in India.

For any businessman, finance is paramount, especially in the initial phase of business. You may face a shortage of funds during the infancy of your business. My story is no different. However, when I applied for a business loan from Finway, I experienced a very smooth functioning and hassle-free disbursal process. The experts at Finway were so quick, understanding, and most importantly. Thanks!