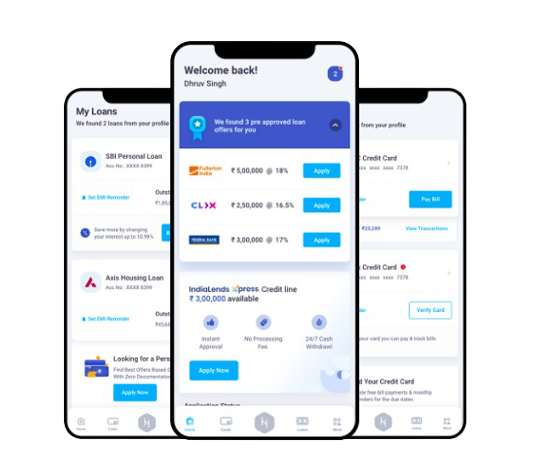

Loan Against Securities (Mutual Funds and Shares)

Feel free to get in touch

about Loan Against Securities( Powered By  )

)

Overview

Financial emergencies have become part and parcel of modern lives.

Expenses like higher education, marriage, starting a new business, medical treatment, etc. require you to spend a lot of money upfront. If you do not have such amount of money in your account, there is a possibility that you might panic. In such a situation if you hold any mutual fund or share in top market can fulfill your urgent requirement by simply pledging the security.

As one of the main players in the finance industry in India, Finway FSC works under the best of their abilities. Obtaining Loan Against Securities is the simple convenient and quickest process. Additionally, the interest rates are much lower as compared to any other options that you can access in situations of financial crunch, such as a personal loan or credit card.

Features & Benefits

You get many benefits on applying with Finway FSC. The interesting thing to note here is that the interest rates charged on such a loan are way lower than those you have to pay on personal loans. The main reason behind this is because it is a secured loan, which requires you to provide collateral for availing it. This reduces the risk and makes it easy for us to approve your loan.

The repayment tenure we offer on LAP is 20 years. This means that you can easily pay it off with lower monthly EMIs. On-time repayment of the loan increases your chances of getting an improved credit score. Also, you can borrow a loan against property from us close to ₹40 lakh without too much paperwork.

| Salaried | Self-Employed | ||

Age |

21 years to 60 years

|

22 years to 55 years

|

|

Net Monthly Income |

Rs.15,000

|

Rs.25,000

|

|

CIBIL Score |

Above 750

|

Above 750

|

|

Minimum Loan Amount |

Rs.50,000

|

Rs.50,000

|

|

Maximum Loan Amount |

Rs.25 lakh

|

Rs.30 lakh

|

|

Documents Needed

- Identity Proof (Aadhaar Card, Voter ID, Driving License, Passport, etc.)

- Address Proof (Valid ID proof with permanent address)

- Income Proof (Bank statement from the last 3 months)

EMI Calculator

How much do you need loan for you?

98%

Satisfied Customers

Reviews

Minimal turnaround time, knowledgeable staff, excellent services, and everything digital; my experience from Finway has been very convenient. Everyone at Finway, not only listens but also understands customers and their needs. This is what a customer looks for when s/he seeks loans from lenders. For me, Finway is a go-to loan provider that keeps everything hassle-free.

The overall experience, starting from applying for a personal loan to its processing, and the final step when I received the loan, was smooth. Thanks, Finway for doing it with no hassles and in such a short interval. Great coordination among the internal teams, unmatched services, diligent follow-ups, all these aspects make Finway a great lending institution in India.

For any businessman, finance is paramount, especially in the initial phase of business. You may face a shortage of funds during the infancy of your business. My story is no different. However, when I applied for a business loan from Finway, I experienced a very smooth functioning and hassle-free disbursal process. The experts at Finway were so quick, understanding, and most importantly. Thanks!