Finway has joined hands with Alphabot.ai, a pioneer in algorithmic trading in India. Unlike traditional mutual funds, Alphabot.ai deals in automated trading of stocks and derivatives with the help of algo trading strategies.

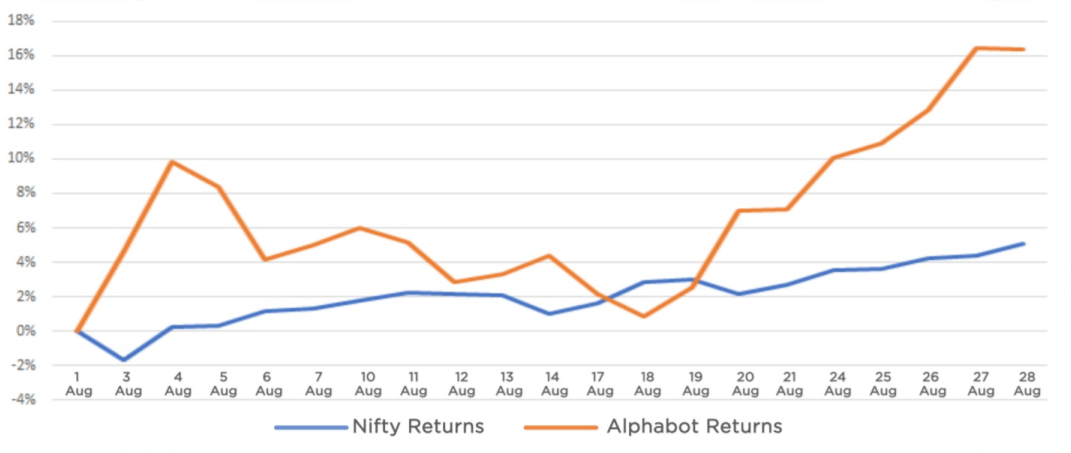

Nifty gave a positive return of 2.88% during the month as shown above in the chart. However, Alphabot's algo trading easily outperformed the NIFTY returns to achieve returns of 16.32% for its investors.

Trading Bots are popularly available software that connect users to trade and make trades on their behalf. Trade Bots work using different indicators and signals, such as moving averages and indices. The idea behind a trade bot is simple - to help users make money in the markets, with minimum effort on their part. High volumes and arbitrage trading are all about complex calculations of probability and mathematics.

Alphabot's setup is straightforward, with a simple user interface - intuitive and strategically designed according to customer trading patterns.

There are two main types of health insurance:

In the battle of man versus technology, technology will have an edge owing to objectivity and zero scope for emotions. Strategy building is an important aspect for long-term successful trading. Algorithms account for variables specific to your chosen markets and provide optimum results.

Most of us are relying more on technology than ever before, and in this league, investors are no exception. Thanks to algorithmic trading, an increasing number of investors are benefiting from optimal market conditions to become stable and richer.

Trading Bots is a process for algorithmic trading used for stock market trade. Trading bots use sophisticated mathematical models and formulas to initiate high-speed, automated financial transactions the goal of algorithmic trading is to trade on specific stock market strategies to generate high profits.

It creates original strategies by quickly completing all the required steps-

Along with significant benefits of algorithmic trading, there are also some risks to consider. AlphaBot eliminates those risks and advises for strategic profits.

An algorithm is a method or set of stated rules designed to carry out precise instructions.

Algorithmic trading, popularly in the form of trading bots uses designed software programs to trade at high speeds and volume based on specified criteria, such as stock prices and prevailing market conditions.

A trader uses algorithmic trading to execute orders rapidly when the stock touches or falls below a specific price. The algorithm might specify how many shares to buy or sell according to market volatility. With Alphabot as your trading support, you can sit back and relax, knowing that trades will take place automatically once the pre-set conditions are met.

Various components of the trading ensure pre-trade analysis and variable components are chosen carefully.

Share your Feedback