Loan Against Property

Feel free to get in touch

about Loan Against Property

Overview

Financial emergencies have become part and parcel of modern lives.

Expenses like higher education, marriage, starting a new business, medical treatment, etc. require you to spend a lot of money upfront. If you do not have such amount of money in your account, there is a possibility that you might panic. In such a situation property, a piece of land or a completely built home can be a great asset for you.

As one of the main players in the finance industry in India, Finway FSC works under the best of their abilities. Obtaining a Finway Loan Against Property is a simple and convenient process and is advantageous in many ways. Additionally, the interest rates are much lower as compared to any other options that you can access in situations of financial crunch, such as a personal loan or credit card.

Why opt for Finway FSC Loan Against Property

Do not worry, as your mortgage loan against property will no longer take ages to get approved. Finway FSC has a lot to offer you with its customer-centric approach. We deliver a wide range of loans against commercial or residential assets. You can prevent the burden of any loan from falling on your shoulders by repaying it on time. Therefore, we offer you top-notch post-disbursement services, which makes loan repayment less of a hassle. This means that we provide you several repayment options to choose from.

Selecting for a loan against property in Delhi NCR from us can help you throw all the financial worries out of your life. The process of verification of documents generally takes too much time as there is a lot to go through. However, one of the many advantages that we offer you is the efficiently quick inspection procedure of documents. Our professional and experienced team values your time and leaves no room for complaints. Moreover, what is better than a top-up loan which you can get in times of urgent need?

Since Loan Against Property is secured with collateral, there are many financial institutions willing to offer this facility. So, why opt for Finway FSC? The simple answer to this question is that it is a housing finance company and hence, specializes in housing loans and loans against property.

Features & Benefits

You get many benefits on applying with Finway FSC. The interesting thing to note here is that the interest rates charged on such a loan are way lower than those you have to pay on personal loans. The main reason behind this is because it is a secured loan, which requires you to provide collateral for availing it. This reduces the risk and makes it easy for us to approve your loan. Moreover, with a good credit score, the loan amount can go up to 60% of your property’s value.

The repayment tenure we offer on LAP is 20 years. This means that you can easily pay it off with lower monthly EMIs. On-time repayment of the loan increases your chances of getting an improved credit score. Also, you can borrow a loan against property from us close to ₹40 lakh without too much paperwork.

High-Value Loans

Finway FSC Loan Against Property is a secured loan. Hence, the main advantage of opting for this type of loan is that the loan amount available is substantial and directly linked to the value of the property. Depending on your credit profile, you can get loan amount as high as 60% of the value of the property.

Finway Advantage

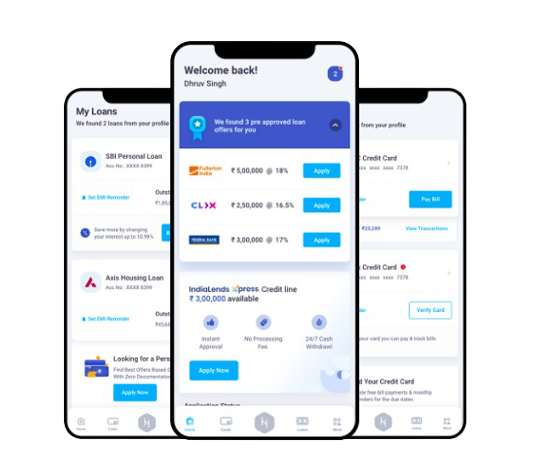

- Instant online approval. Loan sanction in 30 mins, disbursal in as low as 2 hours.

- Loan amount from Rs 5,000 - Rs 5 Crores

- Tenure: 3 months to 18 months

- Interest rate from 12% to 26% per annum

- Processing Fee: 3% to 5% OR Rs. 500, whichever is Higher

Finway Advantage

- Salaried individuals, professionals, and self-employed individuals who are IT assesses are eligible for the loan. For Rent Plus scheme owners of residential building/ commercial property which are to be rented/ already rented to MNCs/ banks/ large and medium size corporate are eligible.

- The loan can be by an Indian resident as well as NRI against self-owned property in their name or in the name of their spouse/children/parents/siblings.

- Minimum net monthly income should be 25000 (for salaried individuals) and minimum annual income of (for self-employed/professionals).

- Regular income from all sources will be considered for arriving at the loan eligibility.

- In addition to the applicant's income, the income of spouse/children/parents/siblings will also be considered for arriving at the eligible loan quantum. If the property is held in joint names, then all the joint holders will be co-borrowers for the loan. If the property is held in the name of the applicant and the loan availed jointly to increase the eligible amount, the spouse/children/parents/siblings can either be co-borrowers or guarantors.

- The age of the borrower should be minimum 18 years at the time of applying for the loan and up to 70 years at loan maturity.

Trusted Banks

Best loan against property offers

from India’s most trusted banks

| Salaried | Self-Employed | ||

Age |

21 years to 60 years

|

22 years to 55 years

|

|

Net Monthly Income |

Rs.15,000

|

Rs.25,000

|

|

CIBIL Score |

Above 750

|

Above 750

|

|

Minimum Loan Amount |

Rs.50,000

|

Rs.50,000

|

|

Maximum Loan Amount |

Rs.25 lakh

|

Rs.30 lakh

|

|

Documents Needed

- Identity Proof (Aadhaar Card, Voter ID, Driving License, Passport, etc.)

- Address Proof (Valid ID proof with permanent address)

- Income Proof (Bank statement from the last 3 months)

Property Related Papers

- Permission for construction (if required)

- Registered Agreement for Sale / Stamped Agreement for Sale/ Allotment Letter

- Occupancy Certificate (for ready to move property)

- Share Certificate (for Maharashtra only), Electricity Bill, Maintenance Bill, Property Tax Receipt

- A copy of Approved Plan and Registered Development Agreement by the builder, Conveyance Deed (in case of new property)

- Payment receipts/ bank account statements showing all the payments done to Builder/Seller.

EMI Calculator

How much do you need loan for you?

98%

Satisfied Customers

Reviews

Minimal turnaround time, knowledgeable staff, excellent services, and everything digital; my experience from Finway has been very convenient. Everyone at Finway, not only listens but also understands customers and their needs. This is what a customer looks for when s/he seeks loans from lenders. For me, Finway is a go-to loan provider that keeps everything hassle-free.

The overall experience, starting from applying for a personal loan to its processing, and the final step when I received the loan, was smooth. Thanks, Finway for doing it with no hassles and in such a short interval. Great coordination among the internal teams, unmatched services, diligent follow-ups, all these aspects make Finway a great lending institution in India.

For any businessman, finance is paramount, especially in the initial phase of business. You may face a shortage of funds during the infancy of your business. My story is no different. However, when I applied for a business loan from Finway, I experienced a very smooth functioning and hassle-free disbursal process. The experts at Finway were so quick, understanding, and most importantly. Thanks!

Featured In

FAQs

What are the types of properties eligible for a Loan Against Property at Finway?

You can avail a loan against residential as well as commercial properties.

What is the quantum of loan available under the Finway Loan Against Property?

The quantum of loan ranges from to Crores depending upon the market value of the property and the income of the applicant.

What is the maximum loan to value (LTV) available?

The LTV ratio for loan up to and for loans above. The market value of the property is as per the Valuation Report given by the panel valuer of SBI.

What is the repayment tenure for Loan Against Property at Finway?

The entire loan should be repaid within 5 years to 15 years. Pre-payment and part-payment option is available with no charges.

What are the repayment options available for Finway Loan Against Property?

The following options are available for repayment of the Finway Loan Against Property:

- Through Electronic Clearance Service (ECS)

- By giving a Standing Instruction (SI) to debit the EMI from an account maintained with SBI

- The loan repayment can also be done by Post Dated Cheques (PDCs)

Who is eligible for Finway Loan Against Property?

Salaried individuals, professionals, and self-employed individuals who are IT assesses are eligible for the loan. The loan can be availed by Resident Indians as well as NRIs against self-owned property in their name or in the name of their spouse/children/parents/siblings. The borrower should have a minimum net monthly income of 25,000 (if salaried) or minimum annual income of 3 Lakhs (if self-employed or professional). The age of the borrower should be between 18 years to 70 years..

What is the process of availing a Loan Against Property at Finway?

- To begin with, decide the loan amount

- Submit an application form duly filled along with the required KYC documents, income proof and documents relating to the property.

- Legal Scrutiny of property documents and obtention of Legal Scrutiny Report from the panel advocate of Finway.

- Valuation of the property by panel valuer of Finway

- Interview with the banker

- Sanctioning of the loan by the bank

- Acceptance of the loan by you

- Execution of loan documents

- Disbursement of loan

The process is as follows:

Is tax deduction possible for a Loan Against Property?

No. Tax exemption is not available for Loan Against Property under the Indian Income Tax Act.

Personal Loan Against Property or Unsecured Personal Loan from Finway. Which is better?

Loan Against Property is a type of Secured Personal Loan. Finway has different terms and conditions for secured and unsecured personal loans.

If you are going for a short-term loan, then an Unsecured Personal Loan is better since it does not require collateral security and the processing of the loan is hassle-free and quick. It can also be a great option to create a credit history if you do not have one.

However, if the amount involved is huge, it is better to avail Loan Against Property since the rate of interest is much lower compared to the rate of Unsecured Personal Loan. Also, with the flexible repayment option ranging from 5 years to 15 years, the EMI will be considerably low and affordable with Loan Against Property.