Education Loan

Feel free to get in touch

about Education Loan

Overview

We help you get best Education Loans to study in India and abroad without any collateral or security attached. You can get a loan starting from Rs. 50,000 to Rs. 45,00,000 at attractive interest rates with benefits such as no pre-payment charges and no pre-closure charges.

Education Loan Eligibility Criteria

- Indian Citizenship

- Secured at least 50% marks during HSC & Graduation

- Who have obtained admission to career-oriented courses e.g. Medicine, Engineering, Management etc., either at the graduate or postgraduate level

- Secured admission in India or Abroad through entrance test / merit-based selection process post completion of HSC (10+2)

- Documents displaying regular income is mandatory for the co-applicant (parents/sibling/guarantor)

The education loan eligibility will be determined by Axis Bank as per the Bank's policy prevailing at the time of loan application and disbursement. Documents required for Education Loan Education Loans help you finance your tuition fees, hostel charges, study materials, etc. The Bank provides quick and hassle-free loans once you provide the application and required documents. Find out the documents required for an Education Loan.

Documents Required

- KYC documents

- Bank Statement / Pass Book of last 6 months

- Optional – Guarantor Form

- Copy of admission letter of the Institute along with fees schedule

- Mark sheets / passing certificates of S.S.C., H.S.C, Degree courses

- Demand letter from college or university

- Loan agreement signed by applicant, co-applicants

- Sanction letter signed by applicant, co-applicants

- Disbursement request form signed by applicant, co-applicants

- Receipts of margin money paid to the college / university along with bank statement reflecting the transaction

- Documents for collateral security (if applicable)

- Form A2 signed by applicant or co-applicants in case of overseas institute

Trusted Banks

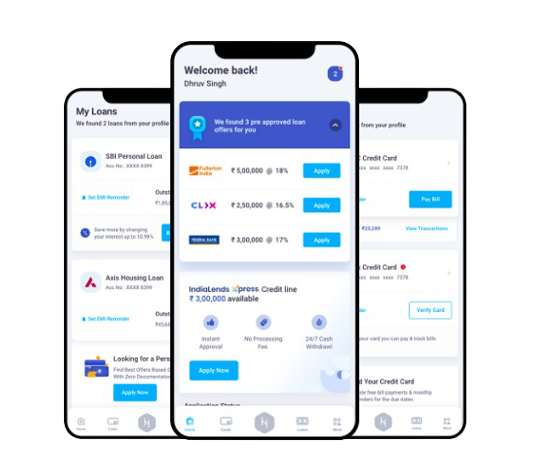

Best Business loan offers

from India’s most trusted banks

| Salaried | Self-Employed | ||

Age |

21 years to 60 years

|

22 years to 55 years

|

|

Net Monthly Income |

Rs.15,000

|

Rs.25,000

|

|

CIBIL Score |

Above 750

|

Above 750

|

|

Minimum Loan Amount |

Rs.50,000

|

Rs.50,000

|

|

Maximum Loan Amount |

Rs.25 lakh

|

Rs.30 lakh

|

|

EMI Calculator

How much do you need loan for you?

98%

Satisfied Customers

Reviews

Minimal turnaround time, knowledgeable staff, excellent services, and everything digital; my experience from Finway has been very convenient. Everyone at Finway, not only listens but also understands customers and their needs. This is what a customer looks for when s/he seeks loans from lenders. For me, Finway is a go-to loan provider that keeps everything hassle-free.

The overall experience, starting from applying for a personal loan to its processing, and the final step when I received the loan, was smooth. Thanks, Finway for doing it with no hassles and in such a short interval. Great coordination among the internal teams, unmatched services, diligent follow-ups, all these aspects make Finway a great lending institution in India.

For any businessman, finance is paramount, especially in the initial phase of business. You may face a shortage of funds during the infancy of your business. My story is no different. However, when I applied for a business loan from Finway, I experienced a very smooth functioning and hassle-free disbursal process. The experts at Finway were so quick, understanding, and most importantly. Thanks!

Featured In

FAQs

What kindly security accepts by the banks while applying for a business loan?

Currently, to avail business loan banks we do not ask for any security. The business loans are offered based on the evaluations of the submitted documents along with the duly filled application.

I am event manager and have been working in the industry for almost 9 years. Am I eligible for a business loan to set up my event management company?

Yes, you will be eligible for availing a business loan based on the evaluation of the submitted document along with your business plan.

Do banks ask for personal details to use an EMI calculator of a business loan?

No, it is not mandatory to provide personal details to use an online EMI calculator

Where I can use the amount received via business loan?

You can apply for a business loan to fulfill the below requirements-

- Fund your new or existing business

- Make additional capital available for your business

- Renovation of home

- Expansion of business

- Expenses for your child's education

How long it takes to know the eligibility of business loan?

In the advent of the Internet, today, most of the banks and lenders offer efficient online services to its customers. With the help of online banking tools, applicants can check their eligibility to avail a business in a fraction of one minute

How much is the minimum and maximum loan amount I can get?

The minimum loan amount offered is Rs. 5,000 and maximum loan amount can exceed Rs. 2 crore, depending on the requirements.

What is the maximum age of availing business loan?

The maximum age of availing a business loan is up to 65 years.

What is the interest rate offered under Business Loan?

Interest rate offered by various banks and Financial Services Companies starts from 14.99% onwards.

For how long I can repay the loan amount?

You can repay the loan amount in minimum 12 months and maximum up to 5 years, depending on the respective bank or Financial Services Company.

Do I need to submit any collateral to bank before applying for a business loan?

No, you are not required to submit any collateral to bank or Financial Services Company.

What are the foreclosure charges and processing fees of business loan?

The foreclosure charges and processing fees varies from bank to bank. Every bank and Financial Services Company has different charges, so you need to check online from their official website.