Business Loans

Feel free to get in touch

about Business Loans

Overview

Nearly 3 million Indians from all over the country, and all walks of life, trust Finway Capital as their partner to fulfil a host of needs.

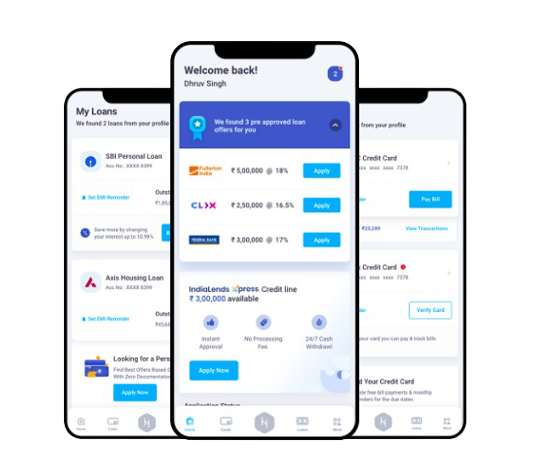

An instant business loan is a type of loan that is offered by banks and financial institutions to provide quick funding to small and medium-sized enterprises (SMEs) to meet their business needs. The loan application process for instant business loans is usually quick and hassle-free, making it a popular choice for businesses in need of quick capital.

When it comes to instant business loans online in Bangalore, the loan application process is entirely online, and the borrower can apply for a loan from the comfort of their home or office. Bangalore, being a hub for startups and small businesses, has several banks and financial institutions that offer instant business loans online.

The eligibility criteria for an instant business loan online in Bangalore may vary from lender to lender. However, some common requirements include a good credit score, a stable income, and a valid business registration. Additionally, the borrower must provide relevant documents such as proof of identity, address, income, and business registration.

One of the significant advantages of instant business loans online in Bangalore is that the loan disbursal time is very quick, sometimes even within 24 hours of loan approval. Additionally, these loans often come with flexible repayment options and competitive interest rates.

It is important to note that while instant business loans online in Bangalore can provide quick and easy funding to businesses, they often come with higher interest rates compared to traditional business loans. Therefore, it is essential to compare the interest rates and terms of various lenders before selecting a loan provider.

An instant business loan online in Bangalore is a quick and convenient way for small and medium-sized businesses to obtain funding. However, it is crucial to consider the terms and conditions of the loan and ensure that it aligns with the business's financial goals and capabilities.

Finway Advantage

Finway FSC's business loans with a business touch!

Finding the perfect business loan for you is the first, most important step. We at Finway FSC work tirelessly to exceed your expectations, and simplify all that you need to know. Whether you are looking at managing debt or dealing with an unexpected expense, we are right there when you need a timely solution. With simple and convenient processes, you can apply for an instant business loan online. business Loans from Finway FSC come with several benefits and features, including minimal documentation, flexible repayment, quick disbursals, and maximum value for money.

- Convenient and Time-Saving: The online application process for instant business loans saves time and effort, as businesses do not need to visit the lender's office to apply for the loan.

- Access to Funds: Instant business loans online provide quick access to funds, enabling businesses to meet their urgent funding requirements and keep their operations running smoothly.

- Improved Cash Flow: Instant business loans online can help businesses improve their cash flow by providing them with the necessary funds to meet their expenses and invest in growth opportunities.

- No Collateral Required: Since instant business loans online are unsecured, businesses do not need to provide any collateral, making it easier for them to obtain funds.

- Competitive Interest Rates: Lenders offer competitive interest rates on instant business loans online, making it an affordable option for businesses looking for quick and convenient funding.

- Boosts Credit Score: Repaying instant business loans online on time can help businesses improve their credit score, making it easier for them to obtain funding in the future.

- In conclusion, instant business loans online in Bangalore come with a range of features and benefits that can help businesses meet their funding requirements quickly and conveniently. With their fast approval, flexible repayment options, competitive interest rates, and no collateral requirement, instant business loans online are an attractive funding option for small and medium-sized businesses looking to grow and expand their operations.

Trusted Banks

Best business loan offers

from India’s most trusted banks

| Salaried | Self-Employed | ||

Age |

21 years to 60 years

|

22 years to 55 years

|

|

Net Monthly Income |

Rs.15,000

|

Rs.25,000

|

|

CIBIL Score |

Above 650

|

Above 650

|

|

Minimum Loan Amount |

Rs.50,000

|

Rs.50,000

|

|

Maximum Loan Amount |

Rs.50 lakh

|

Rs.50 lakh

|

|

Documents Needed

- Identity Proof: A valid identity proof such as PAN card, Aadhaar card, passport, or driving license.

- Address Proof: A valid address proof such as electricity bill, telephone bill, passport, or driving license.

- Business Registration Proof: A valid registration proof of the business entity such as Sole Proprietorship, Partnership deed, Certificate of Incorporation, or LLP Agreement.

- Bank Statements: The latest bank statements of the business for the last 6 months.

- Income Tax Returns: The latest income tax returns of the business and the owner/partners/directors.

- Financial Documents: Financial documents such as balance sheet, profit and loss statement, and cash flow statement for the last 2-3 years.

- GST Returns: The latest GST returns filed by the business.

- Other Documents: Any other documents that the lender may require, such as business plan, invoices, purchase orders, etc. It is important to note that the list of required documents may vary based on the lender and the loan amount. The borrower should check with the lender for the complete list of documents required for an instant business loan online in Bangalore.

EMI Calculator

How much do you need loan for you?

98%

Satisfied Customers

Reviews

Minimal turnaround time, knowledgeable staff, excellent services, and everything digital; my experience from Finway has been very convenient. Everyone at Finway, not only listens but also understands customers and their needs. This is what a customer looks for when s/he seeks loans from lenders. For me, Finway is a go-to loan provider that keeps everything hassle-free.

The overall experience, starting from applying for a business loan to its processing, and the final step when I received the loan, was smooth. Thanks, Finway for doing it with no hassles and in such a short interval. Great coordination among the internal teams, unmatched services, diligent follow-ups, all these aspects make Finway a great lending institution in India.

For any businessman, finance is paramount, especially in the initial phase of business. You may face a shortage of funds during the infancy of your business. My story is no different. However, when I applied for a business loan from Finway, I experienced a very smooth functioning and hassle-free disbursal process. The experts at Finway were so quick, understanding, and most importantly. Thanks!