Not just another FSC

Commitment as a company!

Finway is on a mission: To empower Indian by way of digitailzing entire lending process for Personal, Business and Educational Loans

Earn passive income!

FINWAY FRANCHISE

Finway

Wide Network

Finway has well-established network of associated banks, relationship managers

Highly Trusted

Our bouquet of 31000+ satisfied customers speak a lot about us.

Financial Process Simplified

One stop for all financial needs supported by quick and easy process.

The Finway Advantage

Easy – Convenient – Transparent

- 5000+ Partners & Over 40 Products

- 31000+ Satisfied Customers

- Disburses loans worth Rs. 200 Cr. on an annualized basis

- Secured systems to keep your data safe

- One of the most awarded financial company

- Superfast turnaround time

What We’re Offering

calculate your rate

How much loan amount do you need?

What they’re talking about

our company

Cr+

Worth Loan disbursed

+

Partners

+

Products

Satisfied Customers

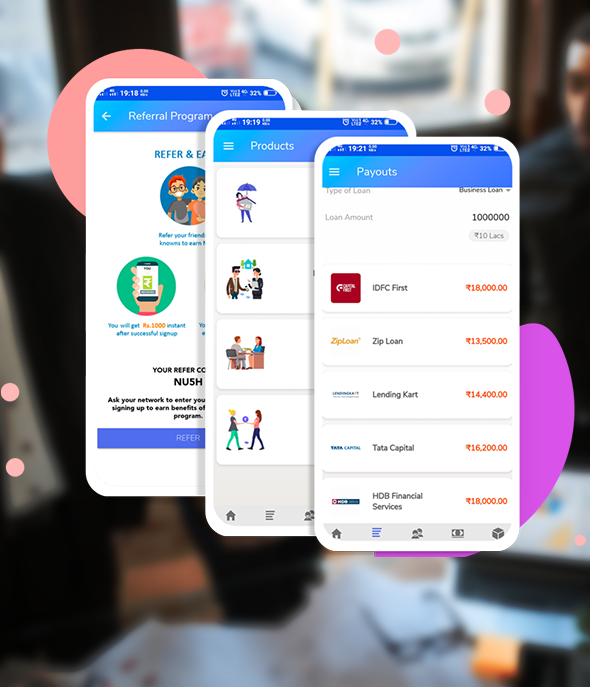

FLAP - Loan Assist for Partners

Anybody Can Earn

A platform where anybody can earn through us

Refer and Earn

‘Refer and Earn’ program where referrer will get additional benefits per successful sign up

Commissions

Partners will get 5% of the total earnings by the team

Highest Payout

Highest agent payout in industry